-

BCH exposes IMF and sector pressure to devalue lempira

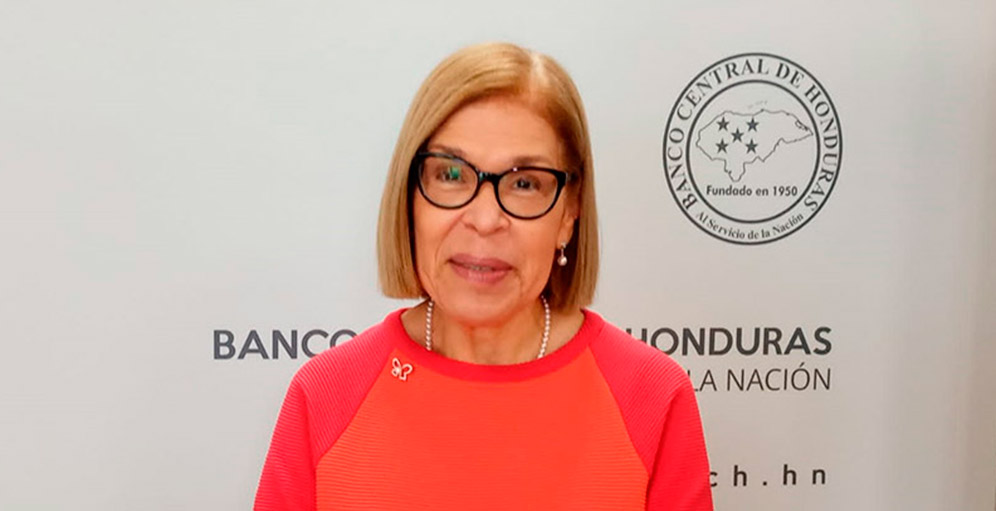

The president of the Central Bank of Honduras (BCH), Rebeca Santos, presented pressure from the International Monetary Fund (IMF) and certain economic sectors to devalue the lempira according to the dollar.

"There is enormous pressure because we move the exchange rate, it is a pressure that comes from the International Monetary Fund (IMF) and within some economic sectors that they believe will benefit them," Santos confessed.

On the side of the Monetary Fund, you think, that this is going to achieve a balance of supply and demand, that from my perspective is not possible because there are sectors that have all the resources to buy the dollars they want. To those of us who would be affected by a devaluation, it is basically the people," said the official.

Rebeca Santos expanded that the foreign exchange auction was resumed, precisely because speculative pressure was being given on the exchange rate. Our currency has been under constant pressure, because there are sectors interested in the lempira being devalued," he insisted.

The representative of the Honduran Economic Cabinet explained that the exchange rate largely is sustained by its dynamics and economic strength, which has been one of the main concerns of President Xiomara Castro.

POLITICS against C.CLICAS

That's why we've implemented policies against cyclicals that many have criticized. The Monetary Policy Rate (TPM) is lowered with the closure of the economy, with the pandemic going to 3.00 percent, but banks did not take that signal as a reference and kept active rates high, so the important thing is that a central bank can make use of any of its instruments.

In this context, Santos warned that I am not married to an instrument called Monetary Policy Rate. There are several instruments that can be used, the important thing is the whole of that policy, to ensure that our economy can have a positive, robust and resilient growth dynamic.

In addition, according to the exhibition since the BCH, 2022 was a year of strong pressures, with crises, after crisis at the international level, affecting an economy as vulnerable as the Honduran economy with inflationary pressures, especially inflation that comes from outside. At the moment, however, that index is already within the top range of inflation.

"We are acting on the basis that our economy, in order not to sacrifice its levels of growth, needs to apply policy against cyclicals, among the external pressures we are experiencing," he reiterated.

3.6% TERTHING

The forecast of the International Monetary Fund, Santos recalled, is that Honduras was going to grow at less than 3.00 percent, precisely by going for a line of greater restriction, however, the reading of the closing of 2023 guaranteed growth close to 3.6 percent.

In that international concert, it's a major growth. Here too is a fiction that why Honduras is not growing anymore. Honduras will grow more when it can have greater installed capacity in its productive apparatus, he said.

A foreign exchange policy is sustainable, he said, when based on the real capacities of an economy that can produce more, but last year it affected a less active and less positive dynamic in the maquila sector.

Meanwhile, in the first two months of 2024, coffee exports left $140 million less, compared to the first two months of 2023. In January we received $21 million less in family remittances, which, in January last year, of course there are smaller flows, he said.

Fortunately, the maquila is recovering, good news for the BCH. Has the agricultural sector been recovering from the policies promoted by the President and the excellent Minister of Agriculture that we have.

We came from negative rates, last year, we had the best productions of basic grains and that is one of the main elements that has helped us to reduce inflationary levels, we have had food.

"It is no one unknown that this economy is basically an importer, so it is clear that stimulating more the demand for foreign exchange was going to generate these imbalances that the bank dragged," concluded the president of the Central Bank of Honduras. (WH)

DATA

The Reference Exchange Rate (TCR) of March 7, 2024 was L24.6748 for US$1.00, registering an annual depreciation of 0.42% (L0.103 cents) and 0.095% (L0.024 cents) when compared to the closing of 2023, according to the weekly executive summary of financial system indicators, from 1 to 7 March 2024.Reference Exchange Rate (lempires for US$1.0) Source: Department of Exchange Operations.

Login or Register to Leave a Comment