-

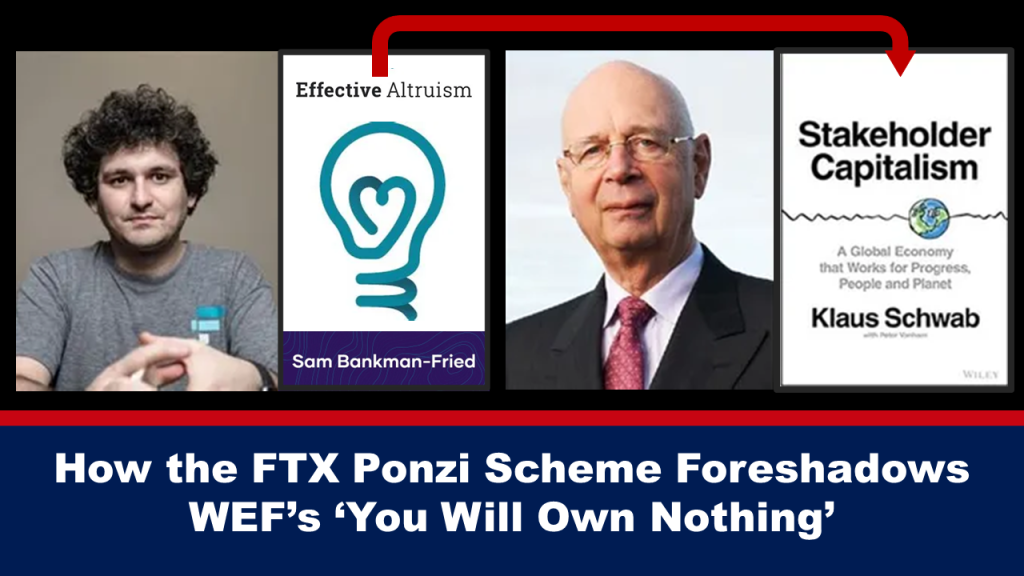

How the FTX Ponzi Scheme foreshadows WEF’s ‘You Will Own Nothing’

Many have suspected that the US government’s “security assistance” to Ukraine — which as of 15 November 2022, had surpassed $98 billion — is a money laundering scheme, perhaps relating to questionable activities involving American biolabs in Ukraine.

With the sudden implosion of the cryptocurrency exchange FTX, suspicions of money laundering in Ukraine are gaining fresh support.

FTX’s founder, Sam Bankman-Fried — suspected of having absconded with $1 billion to $2 billion of client funds as the exchange went belly-up in mid-November — was a top donor to the Democratic Party, second only to George Soros, and had ties to the World Economic Forum.

FTX partnered with Ukraine to help them raise funds for the war effort. Some believe the foreign aid the Ukrainian government received from the US was put into FTX, which then turned around and donated money back to Democratic candidates.

An estimated $200 million were raised for Ukraine and distributed through FTX to a bank in Ukraine, but records show the Ukrainian government only used $22 million of that money. The remaining $178 million appears to have vanished, leading people to suspect it was laundered back to the United States.Many have suspected that the U.S. government’s “security assistance” to Ukraine — which as of 15 November 2022, had surpassed $98 billion1,2 — is a money laundering scheme to somehow ensure its own security, perhaps relating to questionable activities involving American biolabs in Ukraine.

With the sudden implosion of the cryptocurrency exchange FTX,3,4 suspicions of money laundering in Ukraine are gaining new support.

As scrutiny into FTX increases, people are finding more and more links between the ill-fated crypto exchange, the Democratic Party, Ukraine, the World Economic Forum (“WEF”) and even the suppression of Covid-19 treatments through the funding of fake science.

FTX, along with the Bill & Melinda Gates Foundation actually funded the TOGETHER trial,5 which sought to identify “effective repurposed therapies to prevent the disease progression of Covid-19.” Using fraudulent trial protocols, this trial concluded that ivermectin and hydroxychloroquine were useless.6 Of course, to discourage criticism, the trial was given a “Trial of the Year” award for excellence.

Where Did All the Money Go?

Judy Morris for Peace, Liberty & Prosperity summarised many a sentiment in a 13 November 2022, Substack article:7

“Did you ever wonder where all those billions of dollars were going in Ukraine? Did you ever wonder why anyone was trusting the elites in US politics like the Bidens with billions in funds going to Ukraine? Today it turns out that these were excellent questions.

“We have information that the tens of billions of dollars going to Ukraine were actually laundered back to the US to corrupt Democrats and elites using FTX cryptocurrency. Now the money is gone and FTX is bankrupt.”

FTX, the Democratic Party and Ukraine

FTX’s founder, 30-year-old Sam Bankman-Fried — now suspected of having absconded with $1 billion to $2 billion8,9 of client funds as the exchange went belly-up in mid-November — was a top donor to the Democratic Party, second only to George Soros.10

During the 2022 midterms, Democrats received nearly $38 million from the crypto billionaire,11 and in May 2022, he said he was planning on contributing anywhere from $100 million to $1 billion in support to the Democrat nominee in the 2024 presidential election.12

Bankman-Fried reportedly visited the White House on several occasions, and is said to have consulted with the Biden administration on crypto regulation. FTX is also a partner of the WEF. The WEF has now scrubbed FTX from its partner list,13 but an archived link14 confirms the relationship.

As noted by ReallyGraceful in the video below, and in the embedded summary further below, in addition to Bankman-Fried himself, other family members also have direct ties to the WEF.

Really Graceful: What the Media Won't Tell You About Sam Bankma-Fried/FTX, 13 November 2022 (7 mins)

Was FTX Laundering Money for US and Ukraine?

Bankman-Fried’s Ukraine connection involves the creation of an “Aid for Ukraine” initiative in collaboration with the Ministry of Digital Transformation of Ukraine, the Ukrainian Ministry of Finance, the Ukrainian web company Everstake and the National Bank of Ukraine.15,16,17,18

Some believe the foreign aid the Ukrainian government received from the US was put into FTX, which then turned around and donated money back to Democratic candidates — in other words, a money laundering scheme. There’s no concrete evidence for this, however, and deputy minister of Digital Transformation Alex Bornyakov has denied it.19

Still, many believe what FTX was doing was part of a money laundering operation involving Ukraine.20,21,22 While it cannot be proven yet, circumstantial evidences do raise suspicions. As reported by Crypto Hub:23

“In March 2022, FTX was approached by Ukrainian officials who requested help to set up crypto donations to fund the war. Sam Bankman-Fried, the CEO of FTX, agreed and set up a donation portal on the FTX website.

“Businesses and citizens around the world could donate any amount of cryptocurrency to different wallet addresses. Ukraine promised to convert all cryptocurrencies into their local currency hryvnia and subsequently buy war equipment.

“Estimates say that $200 million in donations were raised but from this $200 million only $22 million were officially used. This leaves the question where the other donations went … The remaining $178 million mysteriously disappeared, leading many to believe it had been laundered back to the United States …

“Some believe that Bankman-Fried used his connections in Ukraine to funnel crypto donations back to himself and then used those funds to support the Democratic Party … However, there is no concrete evidence to support this claim.”

A Substack writer that goes by the name “2nd Smartest Guy in the World” posted the following summary of circumstantial evidence:24

What We Know for Sure

What is clear is that FTX worked with Ukraine to funnel overseas donations into its war efforts. FTX converted crypto donations into cash currency. These kinds of transactions are how it made its money.

We also know that Bankman-Fried was in tight with the Democrat party and the Biden administration, itself a rat’s nest of conflicts of interest with regard to Ukraine, as detailed in this previous article. To highlight just one such conflict of interest, Hunter Biden’s investment company Rosemont Seneca is invested in Metabiota, which operates some of the biolabs in Ukraine.

FTX’s head of ventures, Amy Wu, used to work for the Clinton Foundation, Mark Wetjen, head of policy and regulatory strategy for FTX, served as commissioner for the Commodities Futures Trading Commission (“CFTC”) under President Obama, and Bankman-Fried’s trading firm, Alameda, was managed by his girlfriend, Caroline Ellison, whose father is a former supervisor of Biden’s current SEC director.

FTX Proves Stakeholder Capitalism Is a Disaster

Some commentators have homed in on the partnership between FTX and the WEF, noting the collapse of FTX is a foreshadowing of what will happen if stakeholder capitalism is allowed to really take root and become norm. ZeroHedge writes:25

“What many in the mainstream are missing … is [Bankman-]Fried’s attachments to the [WEF], various global elitists and his avid sermonising of the tenets of ‘effective altruism,’ which are nearly identical to the tenets of Klaus Schwab’s stakeholder capitalism agenda.

“The WEF lists FTX as a corporate ‘partner’ and participant, which means the company must meet the globalist organisation’s standards for stakeholder capitalism, a socialist economic model which deconstructs the … free market foundation …

“The WEF insists … corporate leaders should become cultural and political leaders fulfilling greater ideological goals, all of them decidedly socialist/Marxist in origin.

“Stakeholder capitalism becomes a way to trick the public into investing their faith in corporate leadership because these companies are no longer simply ‘in it for the money,’ they are in it for the survival of the world and the species, right? …

“That kind of blind faith allows people to be taken advantage of in a big way … In the WEF’s vision of the future, the average person will ‘own nothing, have no privacy and be happy about it’ while corporate elites in partnership with governments micromanage all production, all distribution and all finance.”

FTX the Largest Ponzi Scheme in History

Charles Hugh Smith shared some helpful insights as to precisely how FTX was able to pull off the largest Ponzi scheme in history.26

“What you will find is insight into the real innovation of FTX: FTX compressed the entire playbook and history of financial fraud into one brief cycle of the credulous bamboozled, Charles Ponzi bested and creative accounting being revealed for what it really is, fraud.

“All financial frauds share the same set of tools. The toolbox of financial fraud, whether it is traditional or crypto-based, contains variations of these basic mechanisms:

1. Using clients’ capital (without full disclosure) to increase the private gain of the Owners of the Con (OOTC).

2. Using the clients’ capital to arbitrage yield differentials in duration, risk and other asymmetries to the benefit not of the clients but to the Owners of the Con (OOTC).

3. Overstate assets by listing illiquid, insider-controlled, non-marked-to-market assets at valuations completely disconnected from reality, i.e. what they would fetch on the open market in size. Rely on assets issued by the firm or its subsidiaries for the bulk of the firm’s assets, i.e. its claim of solvency.

4. Attracting new capital investments and client funds with ‘too good to be true’ (but borderline plausible, given the fantastic growth and track record of high returns) returns, goals and promises to cover the normal churn of redemptions, so the fraud goes undetected. (Ponzi Scheme)

5. Play fast and loose with leverage, the full extent of which isn’t disclosed to clients or regulators.

6. Issue securities (i.e., ‘money’ — tokens, bonds, shares of stock, etc.) whose value is based on the firm’s fraudulently listed assets and mouth-watering growth.

7. Persuade investors and clients that you’re doing them a favour by letting them get a piece of the action. In other words, exploit their near-infinite greed.

8. Present a facade of prudent, audited, transparent, regulated stability which cloaks the interlocking network of fraud, bogus accounting, illiquid assets, etc. and insider looting.”

Advanced Insights for Those Knowledgeable Regarding Crypto

The video directly below is from a friend of mine, Mark Moss. I have spoken at his last two events, and he has a solid handle on this mess. Mark has a strong understanding of financial reality and the crypto space. I strongly recommend it.

Mark Moss: Evidence FTX Was a Deep State Plan to Capture Crypto, 16 November 2022 (38 mins)

Two other leaders in the crypto field, Peter McCormick and Preston Pysh also discuss the absolute insanity of the FTX scandal, see video below. They even give SBR (Sam Bankman-Fried) a new acronym, Scam Bankrupt Fraud. If you understand crypto you will really enjoy this detailed analysis. Preston has extensive experience in the financial journalism world and shifted to crypto several years ago.

What Bitcoin Did: Bitcoin is the Answer with Preston Pysh, 16 November 2022 (65 mins)

FTX Theft Foreshadows WEF’s ‘You Will Own Nothing’ Promise

The environmental, social and corporate governance (“ESG”) credit system is an early phase of the new financial system envisioned by the WEF. Basically, your ESG score decides your company’s ability to obtain loans and investment opportunities, and in the future, the same “social conscience” type scoring will apply to private individuals as well.

As shown in the Fox News video above, Bankman-Fried was hailed as the most generous billionaire on the planet, and he made bold promises to finance globalist causes such as climate change with billions of dollars.

Was his promotion of ESG and stakeholder capitalist ideology the reason why people who should have known better turned a blind eye to what was clearly a fraud? For a summary of the fraud, see ReallyGraceful’s video earlier in this article article. Apparently, blatant drug use advertised on social media didn’t even raise warning flags.

As noted by ZeroHedge:27

“Evidence is mounting that the equity measures involved in stakeholder capitalism will actually erase wealth rather than create wealth. To be sure, it would make the majority of people financially even — instead of being equally rich, we will all suffer in equal poverty.

“The downfall of FTX and Sam Bankman-Fried illustrates this problem with clarity. Fried constantly espoused the pie-in-the-sky ideals of stakeholder capitalism, engaging in a kind of corporate charity built on socialist guidelines and climate cultism, while at the same time draining client accounts.

“Fried suggests that his intent all along was to expand capital as a means to give it away to leftist causes … The problem was he failed in business while giving away the money of his clients at the same time … Fried explicitly stated that his company would not use client funds in such a way. He lied to them …

“Fried is a perfect example of why corporation leaders have no business being involved in social engineering. They are not qualified enough nor intelligent enough nor benevolent enough to mould society at large …

“Beyond that, the stakeholder capitalism ideology is rooted in socialist drivel … The model is designed to inevitably reduce the standard of living for most people over time rather than improve it. Fried just showed us how and why.”

Was FTX Set Up to Fall?

The meteoric rise and sudden cataclysmic collapse of FTX also appears to have been manufactured to serve a larger geopolitical purpose. The proverbial ink on headlines announcing the vaporisation of billions of dollars had barely dried before US Treasury secretary Janet Yellen announced the crypto market will require “very careful regulation” moving forward.28

FTX’s collapse “shows the weakness of the entire sector,” she said.29 As noted by ReallyGraceful, it seems Bankman-Fried was set up to be the “fried bank man.”

Is it just a coincidence that the march toward CBDCs in the US started last week, when the Federal Reserve Bank of New York’s Innovation Centre (“NYIC”), announced that it would be launching a 12-week proof-of-concept pilot for a central bank digital currency, or CBDC? 30

The Australian government has also doubled down on its commitment towards a robust regulatory framework for crypto.31 Daily Skeptic‘s Joshua Stillman adds concerns about CBDCs:32

“Given the ubiquity of credit and debit cards, payment apps and other online payment systems, digital money has been bound to happen for some time. The risk isn’t the electronic part, that’s inevitable — it’s the fact that a central bank will oversee the digital currency.

“From my vantage point, it’s impossible to overstate the risk presented by CBDC. Whether it’s a utopian vision based on good intentions or a sinister plot to crush our sovereignty, the result may be the same: control. A central bank digital currency has all the downsides of fiat money, plus the added layers of surveillance and programmability overseen by the state.

“If CBDC ultimately becomes the new monetary system, its core features will make it so that world governments will no longer need something like a global health crisis to print money or close society. Lines of code can shape our behaviour and ensure we’re forced to stay home. The entire platform will be designed to expel labour that is no longer deemed necessary.

“Central bank digital currency will enable governments to impose top-down control, à la Chinese Social Credit Score. Some central bankers are even saying the quiet part out loud. Whether or not this is the program’s objective, has there ever been a time in history when governments rejected the power they are given? At this stage, this isn’t some tinfoil hat theorising, either.”

The Stuff Movies Are Made Of

Michael Lewis, author of “Big Short,” reportedly spent months with Bankman-Fried, collecting material for a new book. Time will tell which slant Lewis chooses to go with … Naïve hero? Ruthless crook? Overzealous philanthropist? Heartless thief? Money launderer? Clueless patsy in a geopolitical game of mass control? We’ll have to wait and see. In the end, certain facts remain. Regular people were robbed of billions, while globalists, Democrats and Ukraine got rich.

Sources and References

2 Coffee and Covid November 17, 2022

4 YouTube, How FTX CEO $32 Billion Fraud

5 Twitter Dr. No November 13, 2022

6 Meryl Nass Substack November 15, 2022

7, 17 Peace Liberty Prosperity Substack November 13, 2022

9 Daily Mail November 12, 2022

11, 15, 19 Fox News November 15, 2022

14 Web Archive WEF FTX partnership

16 MRonline.org November 15, 2022

18 PostMillennial November 13, 2022

21 Gateway Pundit November 13, 2022

22, 23 Medium Crypto Hub November 13, 2022

24 2nd Smartest Guy in the World Substack November 12, 2022

25, 27 ZeroHedge November 12, 2022

26 FTX: The Dominoes of Financial Fraud Have Yet to Fall Nov. 16, 2022

28 Markets Insider November 14, 2022

30 NY Fed launches 12-week CBDC pilot program with major banks Nov. 15, 2022

31 Aussie treasurer promises crypto regulation next year amid FTX debacle November, 17, 2022

32 CBDC: How Covid Became the Path to Global Financial Surveillance Nov 18 2022

Login or Register to Leave a Comment